Reputell delivers end-to-end Due Diligence solutions that combine automated intelligence gathering with human expertise. Whether for risk-based KYC, M&A assessments, litigation support, or investigative research, our platform uncovers reputational, financial, political, and legal risks across individuals and entities.

Backed by our proprietary big data infrastructure, Reputell provides access to over 1.2 billion structured profiles of individuals and entities. Our platform draws from thousands of global datasets, multilingual media sources, sanctions databases, and deep/dark web intelligence—offering unmatched depth and breadth of information.

We empower banks, law firms, government agencies, family offices, and investigation companies to make informed decisions using multilingual data—available as instant reports, on-demand deep files, or through live monitoring.

Key Capabilities:

AI-enhanced OSINT + human verification

1,890+ global sanctions, criminal, and PEP lists

Multilingual sources (Arabic, English, French, Russian, more)

48-hour turnaround for Enhanced Reports

Available via API, dashboard, or secure PDF delivery

Risk-Based Background Intelligence

Uncover threats, hidden exposure, and reputational risk across individuals and entities—faster than ever.

Basic Due Diligence Report

Ideal for low-to-moderate risk subjects.

Covers foundational identifiers and red flags

delivered in 24 hours

Use Cases:

Vendor Onboarding

Customer KYC

Identity Risk Screening

Includes:

Personal Information & Alias Variations

Family & Address History

Criminal Records & Sanction Checks (1,890+ global lists)

Employment & Education Verification

Social Media Summary

News Mentions & Media Alerts

Known Associates

Detect early-stage warning signs before onboarding or engagement.

Enhanced Due Diligence (EDD) Report

Designed for high-risk individuals, entities, or sensitive engagements. Combines deep investigation with OSINT, dark web, and multilingual sentiment analysis.

Use Cases:

M&A

High-Value Partnerships

Legal Investigation

UBO Checks

Includes All Basic Items, plus:

· Published Government & Court Records

· Bankruptcy, Litigation & Regulatory Findings

· Social Media & Media Sentiment Analysis

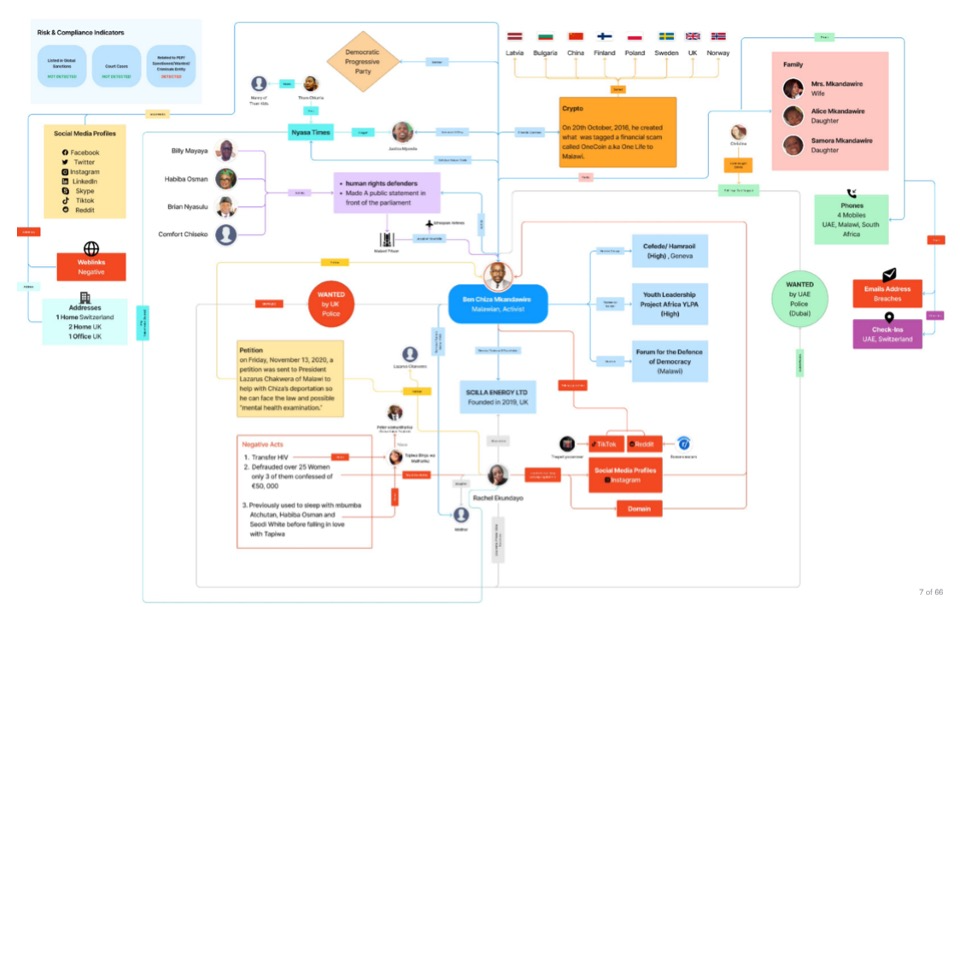

· Ownership Mapping & Network Diagrams

· Deep/Dark Web Exposure

· PEP & Political Affiliation

· Public Opinion Signals

· Relationships & Risk Diagrams

· Analyst Commentary & Executive Summary Risk Flag

Used by financial institutions, family offices, and investigators to avoid reputational, legal, or regulatory exposure.

*All research is conducted within legal and ethical boundaries using only open-source and publicly available information.

Risk Profile Diagram

What’s Covered in Each Report:

PII & Identity

Validation

Criminal Records, Court Filings & Sanctions

Corporate Affiliations & UBOs

Deep Web & Dark Web Exposure

Adverse Media & News Mentions

Social Media Sentiment & Online Presence

Address & Location History

Academic & Employment Checks

Known Associates & Network Web

Credit Risk

& Bankruptcy

PEP & Political

Exposure

Expert Commentary + Risk Flags

Sectors We Serve

Law Firms & Legal Teams

Support litigation, discovery, and investigative cases with deep research and risk intelligence.

Banks & Financial Institutions

Screen clients, counterparties, and UBOs with risk-based reports that meet global compliance standards.

Investigation & Intelligence Companies

Access structured background profiles, source mapping, and OSINT-driven exposure summaries.

Government & Procurement Bodies

Ensure transparency and accountability in vendor selection and public-private partnerships.

Family Offices & Investment Firms

Vet partners, fund managers, and asset targets through financial and reputational due diligence.

Delivery Option

PDF Report

Instant, Basic, or Enhanced

API Integration

Digital onboarding & CRM embedding

Continuous Monitoring

Reputell Risk Watch